POS

Sales Checkout

POS

Purchase Checkout

Delete/Cancel

Purchase

Issue

Quotation

Sales

Checkout(Quotation)

E

Filing Wizard

POS

Sales Checkout

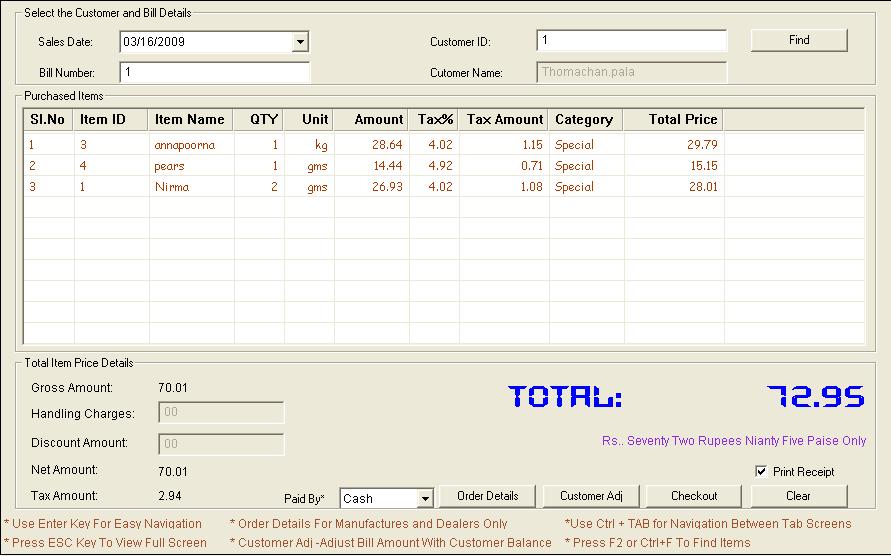

In this menu you can sell items with or without customer

Details. If you want to include customer details then select Include Customer

Details from Setup->Default Settings->POS Default Settings.

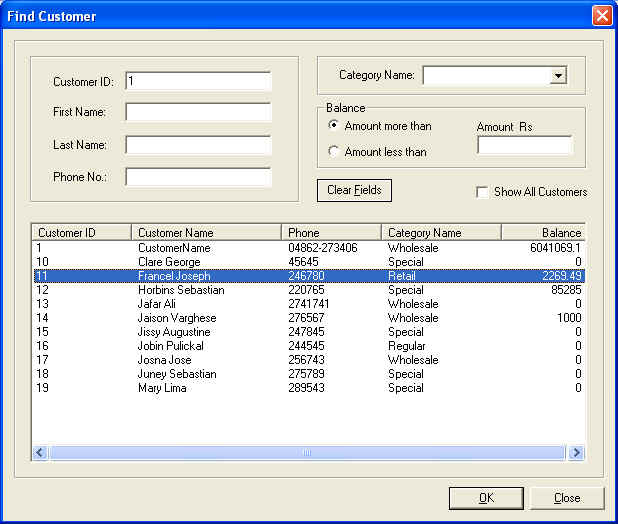

By giving customer ID you can select customers. If you need

more details, then click on Find button. When you click on Find button,

another window Find Customer will appear. Find Customer Screen is as

shown in Fig 124

Then you can select Item Id or Item Name and enter the

Quantity to be sold. In the case of Barcode Readers you need to enter Item Id

Only. There is also a provision to change the category of any item.

If you want to print the receipt, then select Always

Print Sales Receipt option in from Setup->Default Settings->Print

Settings or alternatively you can tick the print receipt checkbox. You

can give Discount and Handling Charge by selecting Allow Handling Charge,

and Allow Discount option from Setup->Default Settings->POS Default

Settings. You can also select Method of Payment. Net Amount, Tax Amount and

grand total will generate automatically.

If you want to adjust the Bill amount with Customer

Balance, Select Customer Adj Button, enter the amount and click Ok.

Manufactures and Dealers need to enter Order details, which

can be done Using Order Details Tab.

POS Sales Checkout Window is as shown in Fig

122.

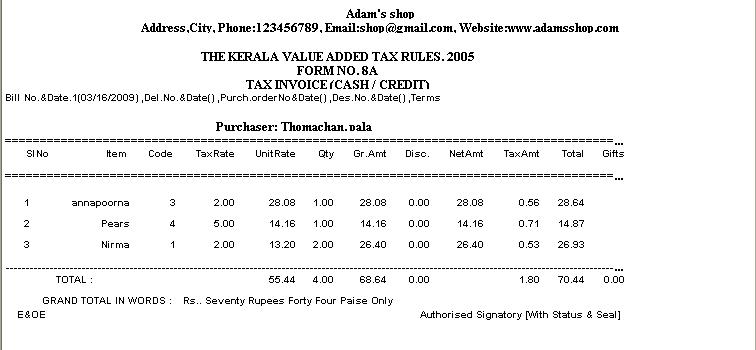

POS Checkout supports different types of Receipts which are

suitable for ‘THE KERALA VALUE ADDED TAX RULES, 2005’ as well as general

formats. In order to set the bill type you can select Bill Type from Set up->

Default Settings ->POS Print Settings. Receipt of POS sales checkout is as

shown in Fig 123.

Fig 122: Sales Checkout Window with the items purchased for a customer

Fig

123: Receipt of Sales Checkout

Fig

124: Find Customer Screen

POS

Purchase Checkout

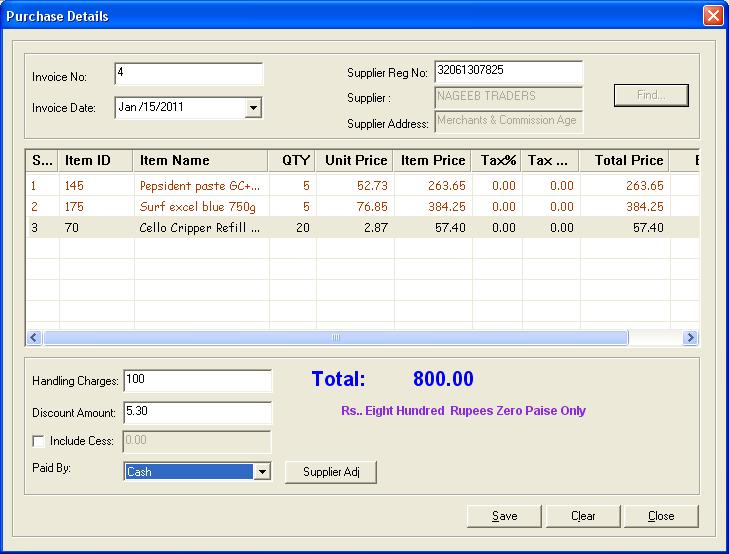

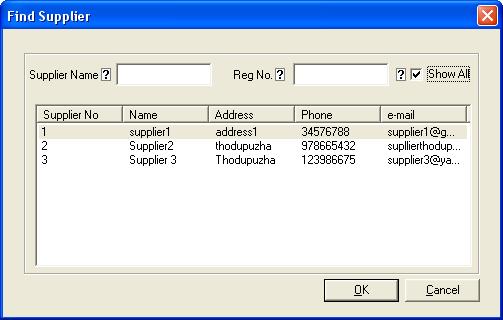

Using this menu you can Purchase items.If you want to

include Supplier details, add Supplier from Setup->POS ->Supplier Info. By giving Supplier Registration number you can select

suppliers. If you need more details, then click on Find button. When you

click Find button, another window Find Supplier will be up.

Then you can select Item Id or Item Name and enter the

Quantity to be purchased. In the case of Barcode Readers you need to enter Item

Id Only.

There is provision to give Discount and Handling Charges.

unit price,Item price,Tax%,Tax Amount and total price will be generated

automatically from the details you have given in the Add New Stock Item

dialog.

POS purchase Checkout Window is as shown in Fig

125.

For finding Supplier, Find Supplier Window is as

shown in Fig 126.

Fig

125: POS Purchase checkout Screen

Fig

126: Find Supplier Screen

Delete/Cancel

Purchase

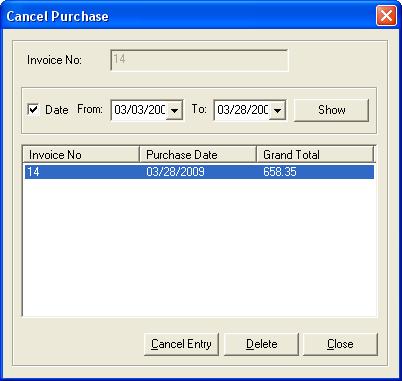

In this menu you can Cancel /Delete purchased items. In

order to display details of purchase either you can enter Invoice Number or

specify a period. In order to give Date ,First select Date (Checkbox) then give

range of dates. Cancel Purchase window is as shown in Fig

127.

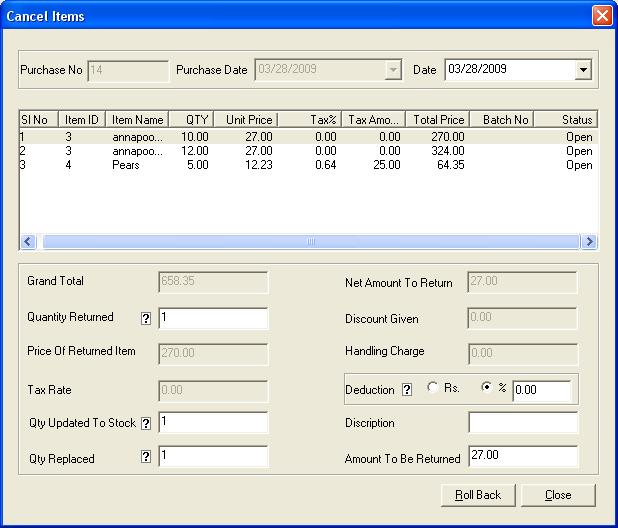

If you want to Cancel the purchase,select a purchase from

the list and click on Cancel Entry ; you will get another window Cancel

Items. Cancel Items window is as shown in Fig 128.

Items Purchased corresponding to Invoice No: will be

displayed as a list in cancel items. From there you can select the cancelling

item. By default, Qty Returned is same as the Quantity purchased. There you can

enter the actual quantity to be returned. Price of returned item,Tax Rate,Qty to

be updated to stock,Qty to be replaced,Net Amount to return,Discount given etc.

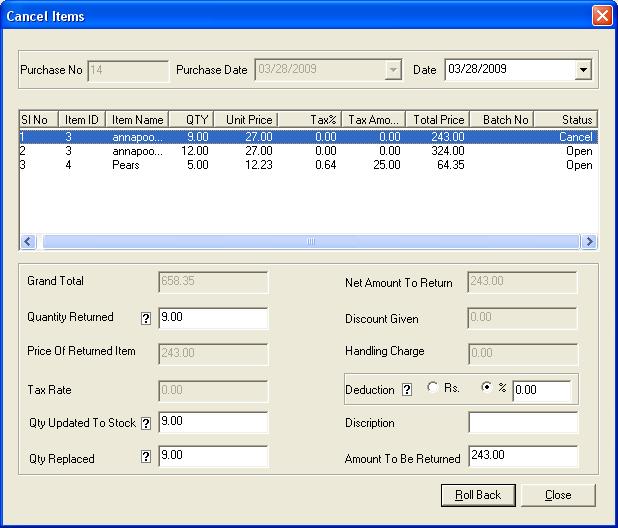

will be automatically filled. Then click RollBack button to rollback the

transaction. After rollback the status of the particular transaction will be

shown as Cancel.The Cancel Items window after rollback is shown in Fig

129.

If you want to Delete the purchase,Select a purchase from

the list and click on Delete.

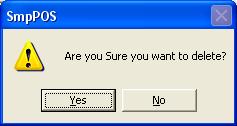

While clicking on Delete Button, a message will appear asking “Are

you sure you want to delete ?â€. If you want to Delete , click on Yes,

otherwise click on No. The Message is as shown in Fig 130.

Then the corresponding invoice number and the complete transaction will be

deleted from database.

Fig

127: Cancel Purchase Screen

Fig

128: Cancel Items Screen

Fig

129: Cancel Items Screen after Rollback

Fig

130: Message asking for conformation of Deletion.

Issue

Quotation

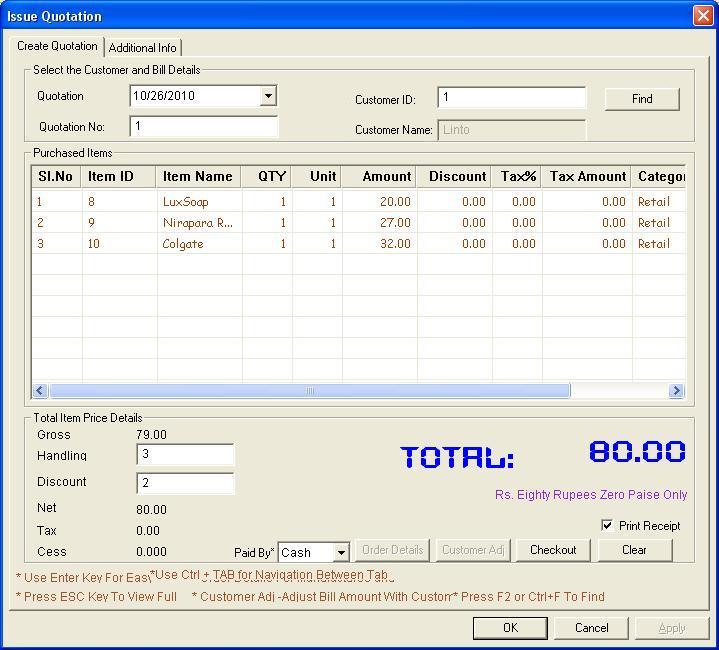

In this menu you can make quotation with or without

customer Details. If you want to include customer details then select Include

Customer Details from Setup->Default Settings->POS Default Settings.

By giving customer ID you can select customers. If you need

more details, then click on Find button. When you click on Find button,

another window Find Customer will appear.

Then you can select Item Id or Item Name and enter the

Quantity to be sold. In the case of Barcode Readers you need to enter Item Id

only. There is also a provision to change the category of any item.

If you want to print the receipt, then select Always

Print Sales Receipt option in from Setup->Default Settings->Print

Settings or alternatively you can tick the print receipt checkbox. You

can give Discount and Handling Charge by selecting Allow Handling Charge,

and Allow Discount option from Setup->Default Settings->POS Default

Settings. You can also select Method of Payment. Net Amount, Tax Amount and

grand total will generate automatically.

Issue Quotation Window is as shown in Fig

131.

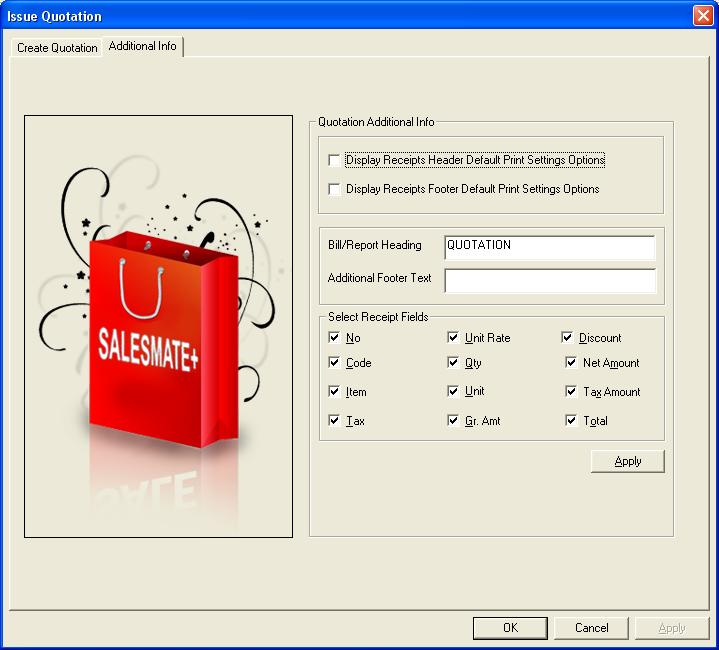

It

is also possible to set the Quotation Bill/Report Heading

using the Additional Info tab.This tab is as shown in Fig 132.

Fig 131: Issue Quotation Window

Fig

132: Additional Info tab

Sales

Checkout(Quotation)

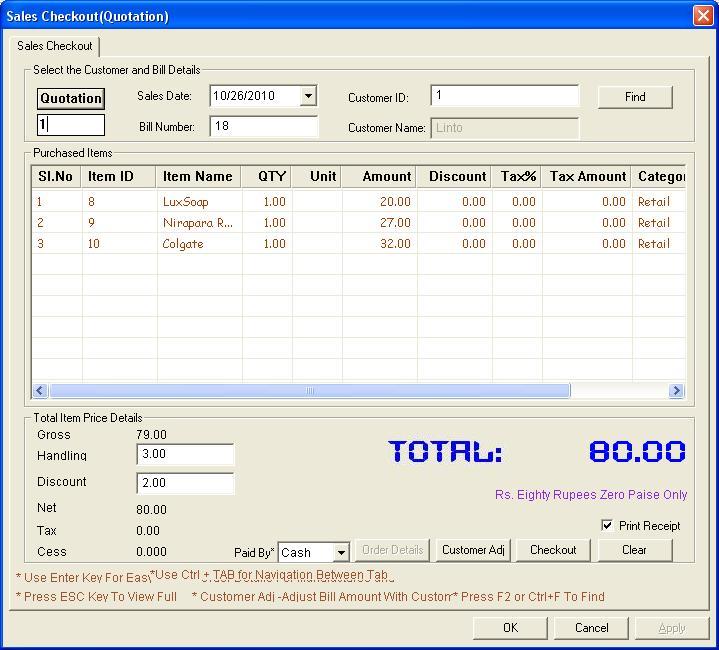

In this menu you can convert a quotation to sales order

with or without customer Details. If you want to include customer details then

select Include Customer Details from Setup->Default Settings->POS

Default Settings.

By giving customer ID you can select customers. If you need

more details, then click on Find button. When you click on Find button,

another window Find Customer will appear.

Then you can select Item Id or Item Name and then enter the

Quantity. In the case of Barcode Readers you need to enter Item Id Only. There

is also a provision to change the category of any item.

If you want to print the quotation details, then select Always

Print Sales Receipt option in from Setup->Default Settings->Print

Settings or alternatively you can tick the print receipt checkbox. You

can give Discount and Handling Charge by selecting Allow Handling Charge,

and Allow Discount option from Setup->Default Settings->POS Default

Settings. You can also select Method of Payment. Net Amount, Tax Amount and

grand total will generate automatically.

If you want to adjust the Bill amount with Customer

Balance, Select Customer Adj Button, enter the amount and click Ok.

Quotation Sales Checkout Window is as shown in Fig

133.

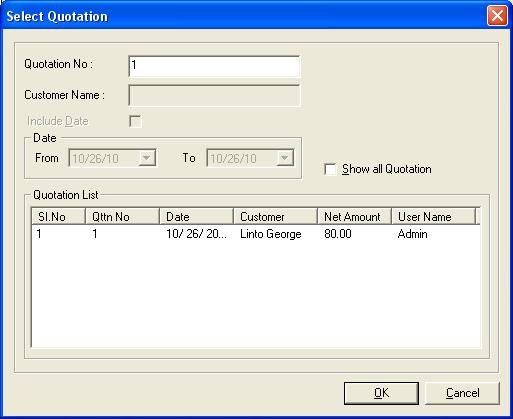

you can also convert an existing quotation to sales

order by clicking on QUOTATION button. When you click on

QUOTATION button, another window Select Quotation will appear. Select

Quotation Screen is as shown in Fig 134

Fig 133: Sales Checkout Window for Quotation

Fig

134: Select Quotation window

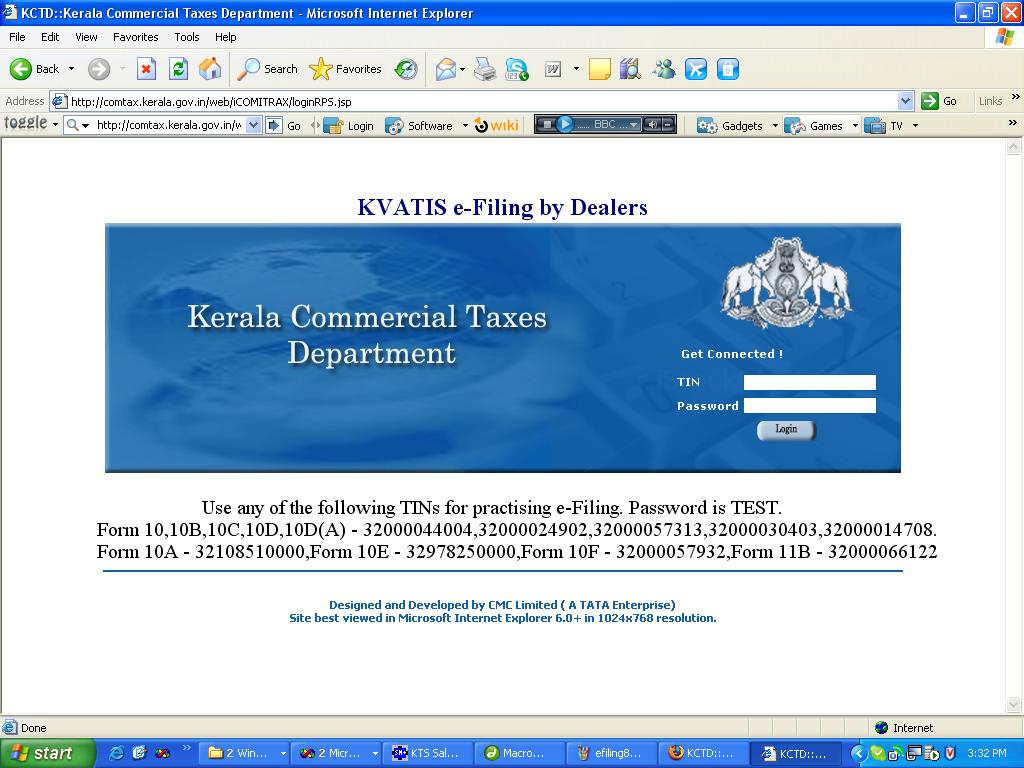

E

Filing Wizard

According to the Kerala value added tax rule, from

01-01-2009 onwards every shop owner in kerala should submit their returns

through online. i.e through the website of kerala Commercial tax department.

This e-filing wizard will help you to submit your returns through internet.

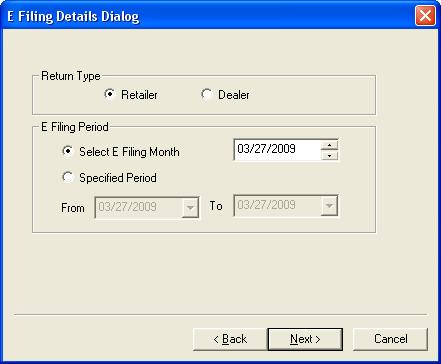

In order to do e-filing from SalesMatePlus

you should click E-filing wizard from POS menu. A welcome page to E filing

wizard appears. Click Next button to start E filing. Select E-filing

month /specified period and return type. Return type is either Retailer or

dealer and this depends upon the shop. The window is shown in Fig135.

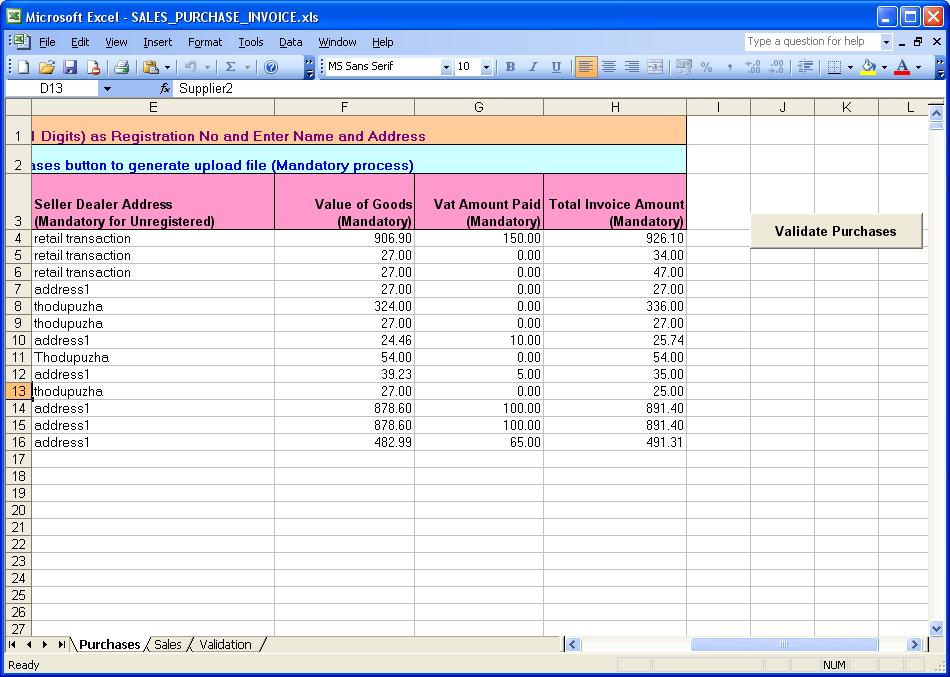

After entering these details, click Next button. This page will export

selected details (purchase and Sales) to the e-filing Excel file. The window is

shown in Fig136 ,tick the check box and click Next

button. Then an Excel sheet will be displayed in which the purchases and sales

done in the particular period/month automatically generated. The purchase tab is

shown in Fig137. There is a Validate Purchases button.

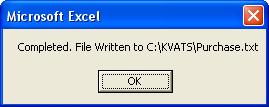

Click the button. If all the details are correct then the purchases will be

exported. And you will get a message shown in Fig138 .

If you dont have any purchase just uncheck the Export purchase details

checkbox.

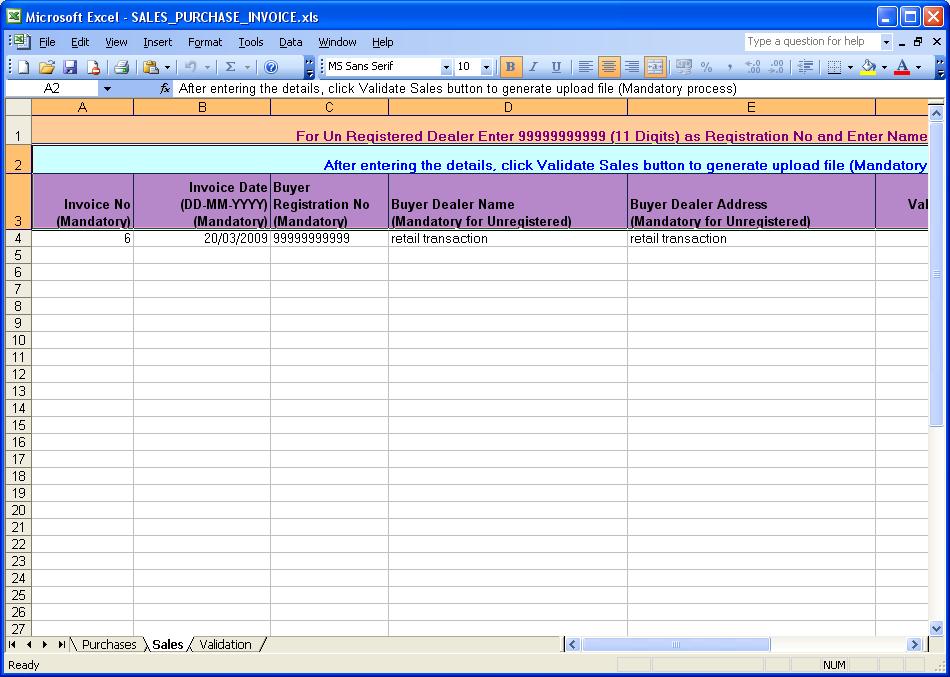

Click the sales tab. The excel sheet contains the sales

details filled automatically. Window is shown in Fig139

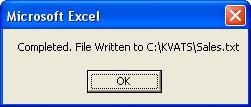

.There is a Validate Sales button. If all the details are correct then

the sales will be exported. And you will get a message shown in Fig140

. If you dont have any sale just uncheck the Export sales details

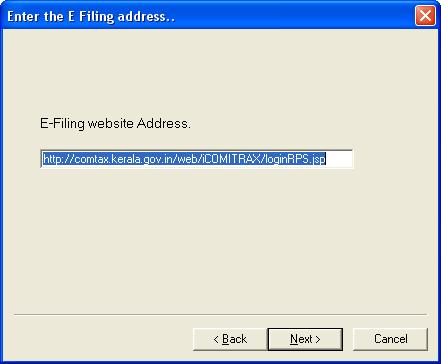

checkbox. Next page contains E filing site address (eg:Kerala Commercial Taxes

Department site.) as shown in Fig141 . You can

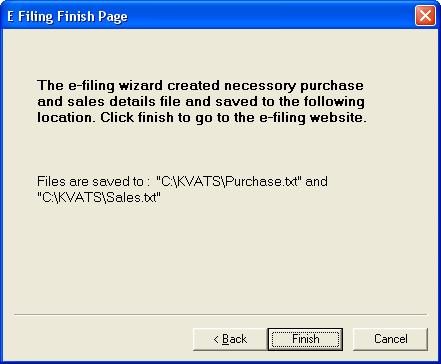

select your E-filing site there.Click Next button again and click Finish

as shown in Fig142 . The Files will be saved into

"C\KVATS\Purchase.txt" and " C\KVATS\Purchase.txt".After selecting Finish

button you will be automatically diverted into the site address given as shown

in Fig143 .

Fig

135: E filing Wizard 1

Fig

136: E filing Wizard 2

Fig

137: E filing Wizard 3

Fig

138: E filing Wizard 4

Fig

139: E filing Wizard 5

Fig

140: E filing Wizard 6

Fig

141: E filing Wizard 7

Fig

142: E filing Finish page.

Fig

143:After finishing e filing wizard user will be redirected to this page.